Did you know there are housing grants of up to $80,000 (BTO) and $120,000 (resale) for first-time HDB flat applicants?

Buying a new flat is a long-term financial commitment that translates into months (or even years) of saving up, so it goes without saying that every single cent counts.

View this project by Space Atelier

Luckily, there IS help: If you’re a first-timer applicant, HDB provides housing grants to take some pressure off the load. Find out more about these subsidies, your eligibility and how much you’ll be getting.

BUT before we begin…

Do note that you only qualify as a first-timer applicant if you haven’t done any of the following:

- Owned a flat bought from HDB

- Sold a flat bought from HDB

- Bought an Executive Condominium (EC); Design, Build and Sell Scheme (DBSS); or HDB resale flat with CPF housing grant

- Taken ownership of Executive Condominium (EC); Design, Build and Sell Scheme (DBSS); or HDB resale flat

- Transferred ownership of a flat bought from HDB, or an HDB resale bought with a CPF housing grant.

- Taken other forms of housing subsidies. e.g. Selective En bloc Redevelopment Scheme (SERS) benefits.

Here are some of the grants available…

| Grant Type | Grant Amount |

|---|---|

| CPF Housing Grant | Up to $50,000 |

| Enhanced Housing Grant (EHG)* | Up to $80,000 |

| Proximity Housing Grant | Up to $30,000 if living with parents; OR $20,000 if within 4km |

*The EHG helps first-time homeowners (with an income ceiling of $9,000) buy new or resale flats.

Source: HDB

Another thing to note is that there are 4 key factors that will determine how much you’re eligible for.

Factor 1: HDB flat type

Based on the type of flat (BTO, EC and resale) that you intend to purchase, you’ll be able to qualify for a number of housing grants. Here’s a summary:

Table 1:

| Type of Flat | Available Grant(s) | Maximum Grant Amount |

|---|---|---|

| BTO | Enhanced Housing Grant (EHG) | $80,000 |

| Resale |

|

|

| EC |

|

|

^ Maximum grant amounts vary by average monthly household income. For more details, refer to Table 2.

Source: HDB

Factor 2: Average monthly household income

View this project by Happe Design Atelier

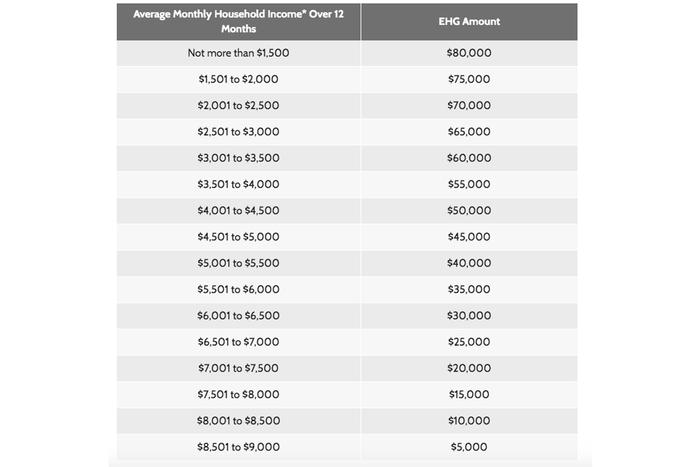

The EHG amount that you will be eligible for depends on your household’s average gross monthly income, calculated over 12 months (prior to the submission of your flat application). Here’s how to calculate the grant amount you can receive:

Table 2:

*All working persons’ (i.e. applicants and occupiers) income are included.

Source: HDB

Factor 3: Family and marital status

View this project by Artmuse Interior

Generally, first-timer singles can enjoy half the grant quantum of what first-timer families can receive (i.e. up to $40,000 for first-timer singles and up to $80,000 for first-timer families); this is to ensure a fair allocation of grants among home buyers.

Factor 4: Employment status (Continuous employment)

According to official guidelines, applicants and/or their spouse/fiancé(e) must be employed at the point they apply for a flat, and “have been continuously employed for the 12 months” prior to the application.

That said, young couples may be able to defer their income assessment for EHG, which would allow them to apply for a flat first before gaining continuous employment.

View this project by D5 Studio Image

Last but not least…

Both the Additional and Special CPF housing grants can only be used for two purposes: One, to offset the purchase price of a flat; and two, to reduce the mortgage loan for a flat purchase.

In other words, these grants can’t be used for the minimum cash down payment as well as monthly mortgage instalment payments. So take note!

(Note: All facts and figures listed in this article are accurate as of the time of publication.)

Get to know HDB and your home better!

This article was adapted in collaboration with MyNiceHome, HDB’s official website for all things related to home buying and renovation in Singapore. Check out the original article here.

Already collected the keys to your HDB flat? Get interior designer recommendations here for free!

Get a budget estimate before meeting IDs

Get a budget estimate before meeting IDs