Much needed respite for your bank account.

With interest rates starting as low as 3.48% p.a. (EIR 6.95%), Standard Chartered’s CashOne Personal Loan is here to ease your financial pressures as you build the home of your dreams.

Plus, enjoy up to $4,100 worth of cashback from now till 31 December 2023!

Read on to find out more.

View this project by Summer Interiors

Key benefits of the Standard Chartered CashOne Personal Loan

- Quick approval, with cash disbursed to any bank account of choice within 15min

- Flexible loan tenure of up to 5 years

- Limited time offer: 3x cashback on first month’s interest*

- New clients get an additional $100 cashback*

*Maximum cashback amount at $4,100.

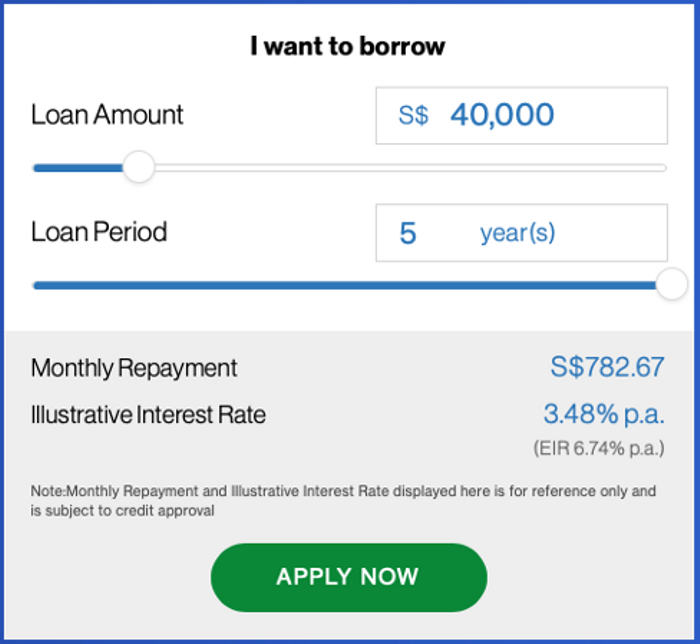

Standard Chartered’s CashOne Personal Loan interest rate calculator

The process is also one that’s upfront and fuss-free, two things we can definitely appreciate.

To get a sense of monthly repayments and interest rates, input your loan amount and preferred loan period into Standard Chartered’s interest rate calculator.

Once you’ve reached a combination you’re satisfied with, submit your application on the Standard Chartered website and enjoy fast approval with Singpass and Myinfo. Existing Standard Chartered clients can also apply easily on the SC Mobile app.

…either approach will literally only take you a few minutes!

CashOne Personal Loan VS. renovation loans

View this project by U-Home Interior Design

You might be wondering why you should choose the Standard Chartered CashOne Personal Loan over a typical renovation loan. Here’s a brief comparison:

| Standard Chartered CashOne Personal Loan | Renovation loan | |

|---|---|---|

| Categorical restrictions | - | Cannot be used for things like loose furnishings and appliances |

| Loan amount | Up to $250,000 | Up to $30,000 (typically) |

| Approval process | As quickly as in a matter of minutes (by accessing MyInfo); get cash within 15 minutes | Requires submission of renovation quotation; approval can take anywhere between a few days to a few weeks |

| Cash disbursement | To any bank account of your choice | Directly to vendor |

*Maximum loan amount will be pegged to income and credit score.

Word to the wise: don’t minimise the importance of each of the above.

For one, most homeowners spend $10,000 to $50,000 on appliances and loose furnishing, on top of the cost of renovation works.

Quick approval is also another reason why the CashOne Personal Loan might be a more viable option for you, particularly when you need funds on short notice. Examples include working with contractors who require upfront deposits to begin works, or if you uncover foundational issues (e.g. water damage, faulty wiring, mould) while hacking a resale property’s interior – all of which must be addressed before other renovation works can resume.

Who it’s good for

View this project by FlipStone Interior Design

If you’re still on the fence choosing between a personal loan vs. renovation loan, the following questions would be helpful in making an informed decision:

1. Do you require funding for multiple things concurrently in this stage of life?

It’s common for couples to have their renovation, wedding and honeymoon in a matter of months. These are once-in-a-lifetime experiences you won’t regret and/or long-term investments, but they can be rather overwhelming when you have to fork out funds for them all at once.

Since funds from a personal loan can be used at your discretion, they offer far greater flexibility than a renovation loan.

2. Do you require a large loan amount?

As discussed in the previous section, renovation loans typically have a hard cap at $30,000. So, if you require a larger loan amount, the Standard Chartered CashOne Personal Loan would be a clear choice for you.

Limited time offer: up to $4,100 in cashback on your first month’s interest

View this project by Salt Studio

Lastly, loans are here to ease you of financial strain as you take a major step into the world of adulting. While you’re at it, you may as well leverage Standard Chartered’s new promotion with 3x cashback on your first month’s interest (capped at $4,100).

And don’t sit on it for too long – this offer ends 31 December 2023, and your dream home awaits!

Get a budget estimate before meeting IDs

Get a budget estimate before meeting IDs