Keep calm and budget on.

Many people see home renovations as a daunting affair, and we totally get it. After all, it’s a huge expense, and ensuring you get the most out of it (without busting your budget) involves a whole lot of planning and research.

So, here’s what you need to do to budget and finance your home renovation more effectively:

P.S.: Read till the end to find out more about your financing options as well as a limited-time cashback offer!

Let your lifestyle guide your renovation needs, not market trends

You can't undergo a home renovation if you don’t know what you want and need out of your home.

View this project by Comfort Home Interior

For instance, if you have kids, you’re definitely going to need extra storage space. However, if you foresee yourself moving to a bigger home in the future, or changing the layout of your kids’ rooms as they grow older, you may want to use modular storage units instead of built-ins. Plus, this lowers your overall renovation cost, too!

View this project by Todz’Terior

Your lifestyle choices can also dictate your material choices – like choosing a sturdier countertop material for those who bake often, or using non-slip tiles for households with elderly.

| Pro tip! |

|---|

| Opt for more cost-effective variants of your favourite materials to minimise renovation costs. For example, if you like marble designs, opt for quartz with a similar look instead, as they are more affordable. For flooring, consider using vinyl over tiles – the latter is not only more expensive, but also involves additional labour costs. |

Whatever your needs are, write them down somewhere, as it’ll help your interior designer of choice plan your renovation.

Research renovation costs beyond just ballpark prices

As part of your research, you should find out the average renovation prices to get a rough gauge of how much you’ll be paying.

On average, HDB renovation costs in 2024 are expected to be around $52,500 to $66,000 for a 4-room BTO flat, or $58,000 to $72,200 for a 4-room resale HDB flat – although this will definitely vary depending on your property type.

But don’t just stop at the overall ballpark prices – to plan your finances more effectively, you’re also advised to find out how much certain renovation works cost, like hacking walls or creating custom built-ins.

For a ballpark price of your entire renovation, simply key in your requirements in our renovation calculator.

Meet 3-5 interior designers to get a gauge of your overall renovation costs

While you may already know the ballpark prices from the previous points, your eventual renovation cost will depend on the specificity of your requirements.

That’s why meeting up with an ID is important, as they have the know-how to give you a specific quote based on what you need.

And this know-how also allows them to advise you on ways to cut down on renovation costs to fit your budget, if need be.

Some things that they may say (that you can also take note of beforehand!) include:

- Rely more on loose furniture instead of built-ins. Carpentry is easily one of the most expensive renovation works, and having numerous built-ins throughout the space will add up.

- Experiment with different paint designs instead of creating a feature wall.

- Consider overlaying existing flooring and cabinets instead of hacking them, especially if your new home is still in good condition prior to renovation.

To get the most accurate gauge of your overall renovation cost (and to glean as much information as possible), you should strive to meet 3 to 5 interior designers. Sure, it can get tiring, but trust us when we say it’s worth it!

Understand your financing options (e.g. low interest personal loans)

Renovations are a huge expense, so you may be feeling the pinch – which is why you should also consider what your financing options are.

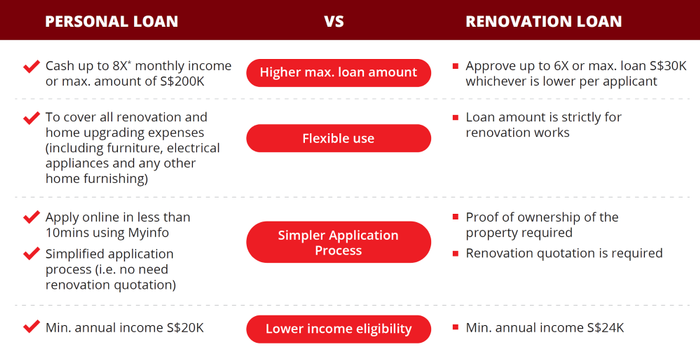

The key options available are personal and renovation loans – and for comparison, here’s a breakdown:

Image credit: CIMB

Personal loans offer flexibility in use to not only renovate your home, but to furnish it as well – and one great option to consider is the CIMB Personal Loan, which boasts a newly-launched interest rate that just so happens to be one of the lowest in the market: it starts from 2.80%* p.a. (EIR from 5.28%)!

With zero processing fees for loan amounts of $5,000 and above, this is easily a great option for anyone looking to renovate their home. Plus, you can take a loan up to 8x* your monthly income, which gives you more cash on-hand and lets you better manage your finances.

Finance your renovation with CIMB Personal Loan

For a limited time only, get cashback of up to $2,000* when you sign up for the CIMB Personal Loan today!

Pro tip: using your MyInfo information to apply will save you the hassle of preparing various documentations beforehand. In total, it will take you less than 10 minutes to apply – simply click the button below to find out more!

*T&Cs apply.

Content sponsored by CIMB Bank Berhad, Singapore Branch (“CIMB”). The information shared above is provided strictly on a non-reliance basis and does not constitute any form of advice from Qanvast or CIMB. You should make your own assessment of your financial situation and needs.

Get a budget estimate before meeting IDs

Get a budget estimate before meeting IDs