It’s not just about creating a home - it’s about protecting it.

With rising property, renovation and living costs, an HDB flat is no longer just a place to roost, but one of life’s biggest and costliest investments! Safeguarding your home from those what-ifs has become essential with so much at stake. In fact, Fire Insurance is mandatory for all homeowners with HDB loans. But what does it cover? And why is there an additional Home Contents plan homeowners can opt for? Read on as HDB-appointed Fire Insurer Etiqa reveals the differences between the two, and why that ‘extra’ Home Contents plan is more necessary than you think.

1. What Types of Damages Are Covered?

Interior Designer: Ace Space Design

The first thing that comes to mind when buying insurance is - what risks or damages does your plan cover? There are many ways which a home may come to harm, and that’s where you’ll see a distinct difference between a Fire and Home Contents plan.

Like its namesake, a Fire Insurance mainly covers fire-related damages, such as:

- Explosions due to gas leaks

- Fire due to short circuiting

- Fire due to earthquakes

- Spontaneous Combustion

- Lightning strikes, leading to fires

- Smoke, and more.

Interior Designer: ELPIS Interior Design

On the other hand, Etiqa’s ePROTECT home, home contents plan covers a much broader scope, including fires, other common and not-so-common damages, such as:

- Natural Disasters (Hurricanes, earthquakes, floods)

- Domestic explosions (from electrical appliances and power points)

- Water-related damages (burst pipes, furniture and electrical damage due to water leakages)

- Car crashes

- Theft

- Riots

In summary: Sure, fires might be the most common source of damage for homes, but life isn’t that simple or straightforward. Think of your Fire Insurance as a basic must-have, and Home Contents as an essential add-on that covers more ‘what-ifs’.

2. What Type of Items Are Covered?

Interior Designer: Summit Design Studio

Many of us assume that the items covered in any home protection plans imply everything related to the house - including floors, walls, fixtures and the contents inside.

Big mistake - turns out that a Fire and Home Contents Insurance each covers two different sets of items in your home.

For one, Fire Insurance isn’t going to protect your $50,000 renovation if it was lost to a fire. The main purpose of the plan is to protect the structural integrity of the HDB flat in case of any damages. That is why it only covers fittings (like the water closet) and the core structure - such as floors, walls or pillars provided by HDB or its approved developers.

Interior Designer: Fuse Concept

Alternatively, a Home Contents Insurance is specifically developed to protect what’s inside your house. This includes any built-in fixtures (e.g. cabinetry, countertops), furnishings, decor, collectibles and even valuables like your jewellery, money and pets that come to harm.

In Summary: Fire Insurance covers the ‘shell’ of your home, but Home Contents Insurance covers things ‘inside’ this shell - basically contents like your renovation works, furniture, decor items and personal belongings.

3. How Much Does It Cover?

Interior Designer: Mr Shopper Studio

Another huge concern on any homeowner’s mind - how much can each Home Contents Insurance cover? Like any protection plan, it all depends on the premium which you’re paying. However, the maximum cap and payout structure between a Home Contents and Fire Insurance is also distinctly different.

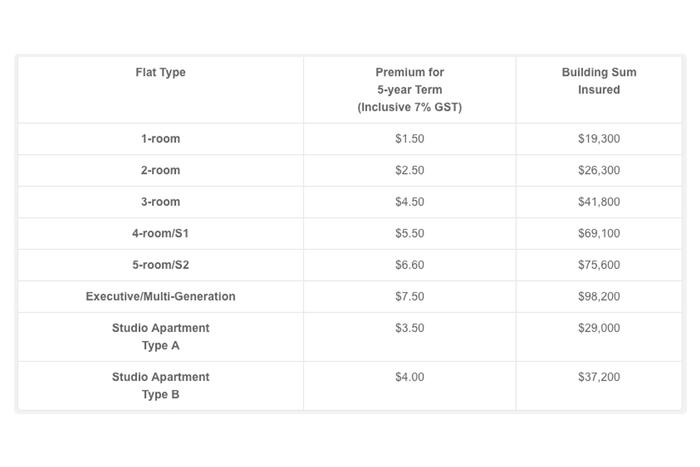

A Fire Insurance is a basic affair. Considering that it is mainly for fire-related accidents and HDB structural elements, it is nothing you can live your days off with - and the maximum cap also depends on the type of HDB you own. Check out the claimable amount for each HDB type in the table below.

Image Source: Etiqa

Interior Designer: Colourbox Interior

Meanwhile, a Home Contents plan like Etiqa’s ePROTECT home covers more risks and items. Though it does have a higher premium, the amount insured is much more substantial. And unlike HDB’s Fire Insurance which pays out based on the HDB unit type, the ePROTECT home plan splits the coverage into these three components:

- A ) Renovation and Home Contents: Up to $150,000*

- B ) Injuries caused by damages on third parties/tenants: $500,000**

- C ) Death of family member caused by damages: Up to $50,000**

*Depending on the plan type chosen

**Amount covered in b) and c) are the same across all plan types.

In Summary: The insured amounts for Fire Insurance plans are much lower, and depend on the type of HDB unit you own. However, a Home Contents plan covers much more regardless of unit type, and amounts claimable are split into three separate components.

4. How Much Is The Premium?

Interior Designer: Aiden-T

For such a huge and costly asset, home protection plans are surprisingly easy on the wallet. To keep it accessible to all homeowners, HDB’s Fire Insurance premiums (which depend on the type of flat you live in) are highly affordable. In fact, the most expensive premium for Executive/Multi-Generation flats costs merely $7.50 for a 5-year term!

Interior Designer: The Local INN.terior

On the other hand, the amount of coverage you can get for a Home Contents Insurance plan also depends on the type of plan you select. In particular, there are three premium types:

- Standard: $60.50 per annum

- Deluxe: $97.10 per annum

- Prestige: $130.90 per annum

Unlike Fire Insurance, Etiqa’s ePROTECT home plan allows homeowners to choose between paying for 1 or 5-year terms.

In Summary: Fire Insurance is always cheaper, but is pegged to the type of flat you live in. Alternatively a Home Contents Insurance like ePROTECT home provides more flexibility and wider coverage - but at the cost of slightly higher premiums.

5. What Extra Stuff Do The Plans Cover?

While not exactly essential, Etiqa’s Home Contents and Fire Insurance plans also come bundled with a set of nifty add-ons to help make your house’s recovery much smoother. Here’s a non-exhaustive list of bonuses thrown in:

For Fire Insurance: Fire extinguishing, architect/surveyors/other consultant fees, removal of debris.

Interior Designer: The Scientist

For Home Contents: Besides those mentioned in Fire Insurance, Etiqa’s ePROTECT home also comes with extras such as the replacement of locks and keys, coverage for loss of pet and unauthorised ATM transactions and even alternative accommodation (for when you’re re-building your home).

In Summary: Comparatively, Home Contents Insurance has extra coverage.

All in all…

If you’re thinking of seriously protecting your home, a basic HDB Fire Insurance is far from providing decent coverage. Think of it as a plan developed to protect a flat’s structural integrity, not the home nor the homeowners in mind.

But a house is more than just a roof over our heads - it’s what we add on to the space within that makes it a home. Which is why a Home Contents plan like Etiqa’s ePROTECT home is a worthwhile addition, as it covers a much broader scope in terms of the type of damages, items and amount covered, providing homeowners a realistic level of protection to any kind of accidents.

Safeguard your home with Etiqa

Specialising in both personal and commercial insurance policies, Etiqa has been HDB’s Appointed Fire Insurer since 2010. To better complement HDB’s Fire Insurance Policy, Etiqa’s Home Contents plan, ePROTECT home, was developed to provide homeowners with a complete peace of mind for one of life’s greatest investments, offering comprehensive protection on house contents and from various home-related perils.

For more information on its policies, terms and conditions, check out Etiqa’s website for Fire Insurance and ePROTECT home, its Home Contents Insurance.

Get a budget estimate before meeting IDs

Get a budget estimate before meeting IDs