It all starts with being more conscious about your spending.

It’s no secret. Other than houses and marriages, home renovations are probably the next biggest expense that young Singaporean adults will face together as a couple. And with the typical renovation costing as much as $44,000 for a 3-room BTO flat to $79,000 for a 5-room resale BTO flat, they can expect to dig even deeper into their savings for their dream home.

View this project by Fifth Avenue Interior

How then does one not feel broke saving up for a renovation while juggling multiple financial responsibilities at the same time? We got Christopher Tan, the CEO and co-founder of local chat-based financial platform sav.finance (@sav.finance), to answer this knotty question, plus more!

Young homeowners in Singapore often find themselves having to juggle between saving for their renovation and other big-ticket expenses. So, what can they do to cope?

Christopher (C): From my experience, plenty of couples I’ve spoken to feel very daunted by the cost of renovation because it’s another big expense to add to the list. But that’s because they haven’t broken it down, so first and foremost, they should find out how much time they need to reach their goal and how much they must save to get there.

Right now, due to the COVID situation, it can take up to 5 years to collect your keys. Assuming that a couple is splitting the cost 50/50 and that the median renovation cost is about $45K, they’ll need to pay about $22.5K each. This translates to them each having to save about $375 every month from the time that they apply for their flat to be able to pay off a renovation fully.

Image adapted from @sav.finance

That also brings us to the 4:1:2:1:2 ratio. I recommend following this rule as a starting point to manage your finances, whereby 40% of your monthly salary should go towards necessities, 10% of it to short-term savings, 20% for investments, and then the next 10% for insurance. Lastly, the remaining 20% is for self-care, which you can spend freely without feeling guilty.

Using the median gross monthly salary of $4,534 in Singapore from MOM, which is about $3,100 in take-home pay after deducting employer (17%) and employee (20%) CPF contributions. This should work out to $1,240 for necessities, $310 each for short-term savings and insurance, and finally, $620 each for investments and self-care.

So, assuming that they aren’t in severe debt and are able to save regularly, it should be possible for a young couple earning close to the median gross monthly salary to be able to accumulate enough savings for their big priorities across time, be it a house, family, or renovation.

But what about couples who earn less than the median gross monthly salary? Is the 4:1:2:1:2 rule then still relevant to them?

C: Most of the younger millennials I have spoken to say that it’s relevant to them, and they earn about $2.4K to $3K in take-home pay. But at the end of the day, this ratio is just a frame of reference, so you can adjust it to your needs and earnings.

For example, if you’re still living with your parents and don’t have kids, setting aside 40% of your salary for necessities might be a little too much, and you can put that money elsewhere either as savings or investments.

Considering that new homeowners may now be looking at a longer waiting period for their keys, how can they capitalise on the extra time?

C: Personally, I’d recommend them to use that extra time to grow their money via a low to medium risk portfolio, perhaps through a robo advisor, which is a great way to start even if you’ve little to no knowledge in investing.

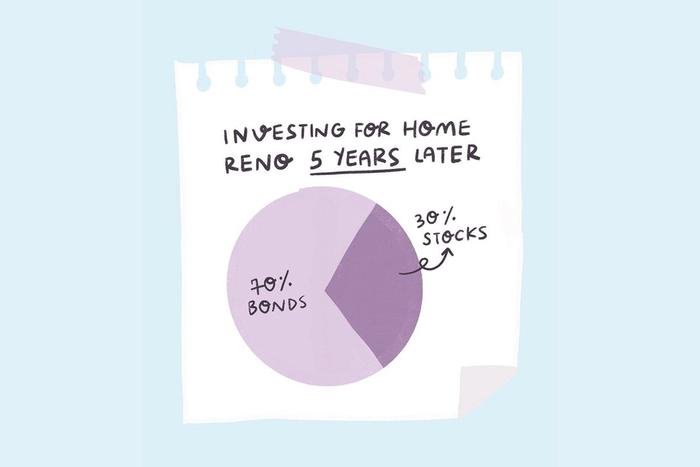

Without being too technical, a portfolio that’s low to medium risk would consist of a mix of fixed-income instruments and equities. Fixed-income instruments include products like bonds, treasury notes, money market instruments, and even some low-risk real estate investment trusts, whereas equities are things like stocks.

Image from @sav.finance

For a low-to-middle risk portfolio, we’re probably looking at a 60:40 or 70:30 split between fixed-income instruments and equities. Equities can fluctuate a lot depending on market conditions, but when they go down, there is an inverse relationship with bonds where they go up. So, an allocation like this can help you balance the win-loss ratio of your overall portfolio.

To add on about using an robo advisor, one key thing to note is that they offer much more flexibility than say investing with an insurance firm, so you can have the liquidity when you need it and you don’t have to invest a big sum at the start.

Also, It’s important to take note of the difference in fees between various investment platforms because they’ll compound and eat into your returns over time. Robo advisors tend to charge about 0.6% to 0.8% whereas I’ve seen insurance firms charge about 3.9% for the first 10 years on an investment plan – that’s a pretty hefty difference.

Finally, do you have any personal money management tips/habits to share?

C: Even though good money management has a lot to do with math, it’s important not to forget there’s an human element involved as well.

If you’re afraid that you aren’t disciplined enough [to save], one thing I’d recommend doing is arranging for an automatic monthly GIRO deposit to a savings account. This way, it’s easier to resist the temptation of splurging when your salary comes in.

Also, for myself, whenever I get tempted to spend on an luxury item, I’d take a ‘2-day cooling period’ instead. That’s enough time [for me] to think about whether I really need the item and how purchasing it might affect my finances in the long run!

This article was brought to you in collaboration with @sav.finance!

Get a budget estimate before meeting IDs

Get a budget estimate before meeting IDs