View this project by Schemacraft

Having a home is one of life’s biggest milestones, but it is also one of the costliest. With a 4-room BTO costing about $290,000 on average, purchasing a property is a huge expense that will take a chunk out of one’s finances for years – even after housing grants are accounted for.

Most homeowners take up home loans (read: CPF vs Cash – Which is Better to Finance a Home Loan?) to offset some of that load, but the additional responsibility can leave little financial room for anything else... like renovations, which is often seen as an ‘optional’ expense.

But why compromise on achieving your dream abode when you can have both? Make your cash work harder for you, with the help of the DBS Multiplier account! With interest rates as high as 3.5% p.a., having enough to create that gorgeous, cosy home you have always wanted need not be a far-fetched dream.

View this project by ChanInteriors

How does the DBS Multiplier work?

In a nutshell, you’ll get to enjoy higher interest rates on your savings in three simple steps:

- Credit your salary via GIRO into any DBS/POSB deposit account

- Have eligible transactions in at least one of the four categories (credit card spends, home loan instalment, insurance, or investments)

- Enjoy higher interests when you hit S$2,000 or more with your eligible monthly transactions (i.e. your salary credit + the total transaction amount from at least one of the categories) to start earning higher interest rates

The interest rate you qualify for in the month is based on your total eligible monthly transactions (i.e. your salary credit + the total transaction amount from at least one of the categories). So, the more you transact in a category and/or the more categories you transact in, the higher your interest rate will be. The higher interest rate applied is capped at the first S$50,000 in your Multiplier account.*

While there’s no minimum credit card spend and no minimum salary credit required – you are required to hit at least S$2,000 total eligible monthly transactions, in order to qualify for higher interest rates.

*Higher interest rates are applicable to the SGD balance in your DBS Multiplier account, up to the first $50,000. Any amount over and above this will be accorded the prevailing interest rate for that month.

View this project by T&T Design Artisan

3 ways how the DBS Multiplier ease your financial load

1. Qualify for a higher interest rate with your home loan transaction

Not only is the DBS HDB home loan rate (currently) lower than HDB’s loan interest rate of 2.6% p.a., your DBS/POSB Home Loan instalments will also be recognised as an eligible transaction under the Home Loan category of the Multiplier Account. Even better? Both cash and CPF repayments are recognised as transactions, providing you more flexibility in your finances.

View this project by Escapade Studios

2. Offset home loan repayments with interest earned

Use the higher interest earned with your DBS Multiplier to help pay for your monthly loan instalments. Simply have S$2,000 or more when you credit your salary and have eligible transactions in any one of the four categories to start enjoying higher interests!

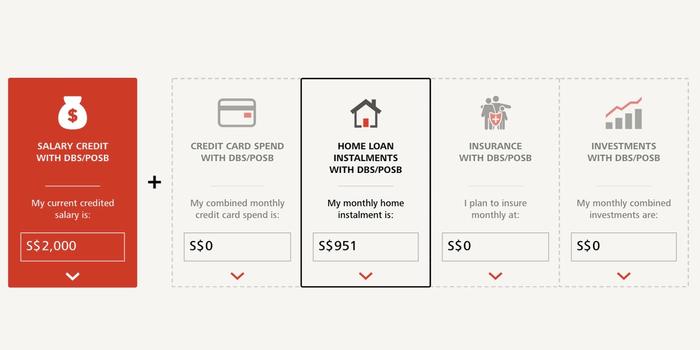

For example:

Note: Home Loan Transaction of $951 / month is computed based on a home loan amount of $225,000, with a loan tenure of 25 years at an interest rate of 1.98% per annum^.

^Source: POSB

With this transaction amount, you stand to enjoy a higher interest rate of 1.85% p.a. on the savings in your Multiplier account. Should you deposit a lump sum of $20,000 in your DBS Multiplier account for the first year, you could then earn $372.30 for the first year, which could be used to offset your instalments. Calculate how much interest you can earn here.

3. Grow your renovation budget

Just accepted the option to purchase for your new property, and waiting to collect your keys in 2 to 3 years’ time? It’s the perfect time to save up for your furniture and fittings purchase.

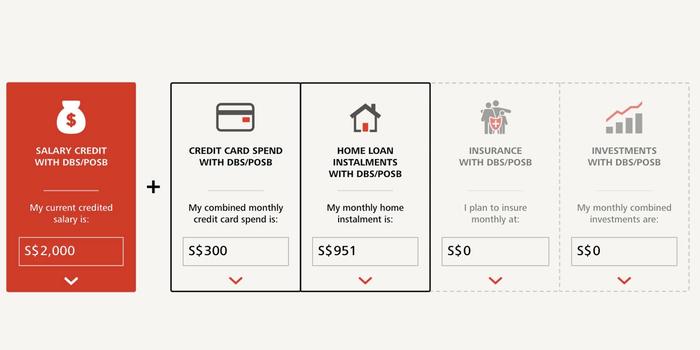

Using back the same example with an additional transaction of $300 on credit card spend:

At this transaction amount, you’ll stand to enjoy a 2% p.a. interest rate. You can earn even higher interest when you fulfill two or more categories.

Should you deposit a lump sum of $20,000, you can earn $401.50 from your deposit for the first year (higher than the first scenario whereby you only had the home loan instalment transaction)! Stretch that out to over 3 years (assuming no other lump sum deposits made), and you could gain up to $1,236 – simply by putting your money in the bank!

While it definitely doesn’t sound like much in the larger scheme of things, an extra thousand bucks could still be very useful in funding that half-wall study room you wanted, getting you fancier bathroom tiles or paying for your furniture pieces. So, start saving!

Find out how much interest rates you can qualify for on the DBS Multiplier site.

This article is brought to you by DBS Bank Singapore.

Prevailing price and interest rates are accurate at the time of time of writing.

Get a budget estimate before meeting IDs

Get a budget estimate before meeting IDs