Savvy spenders only.

From one-off big-ticket purchases to monthly bills, spending on your home can really rack up. To that end, it (literally) pays to be financially savvy and make the most out of the right credit card.

View this project by Le Interior Affairs

Regardless of your financial literacy level or shopping habits, there’s something for everyone.

Here are some of our top cashback picks from UOB:

| Card | Key benefits |

|---|---|

| UOB EVOL Card | 8% cashback on online and mobile contactless spend. - Additional interest rates of up to 7.8% p.a. with UOB One Account. - Insured up to $75k by SDIC. |

| UOB One Card | Up to 15% cashback on daily spend (such as groceries, transport, food delivery, health & beauty, utilities and more) and fuel savings of up to 22.66% at Shell and SPC. - Additional interest rates of up to 7.8% p.a. with UOB One Account. - Insured up to $75k by SDIC. |

| UOB Absolute Cashback Card | 1.7% limitless cashback with no minimum spend, and no spend exclusions. |

For those who don’t spend a lot, but wish to maximise cashback: UOB EVOL Card

View this project by Editor Interior

Amidst increasing costs of living, one thing we’re all grateful for is the rise of massive e-commerce sales (e.g. 6.6, 10.10, Black Friday Cyber Monday) that have made home shopping that much more affordable.

With the UOB EVOL Card, get 8% cashback on all online and mobile contactless spending, and 0.3% on all other spending. Each month, you can snag $60 cashback (or $720 annually), which is broken down into separate caps for various categories:

- Online spend: $20

- Mobile contactless spend: $20

- All other spends: $20

View this project by Posh Home

To help illustrate how this works, here are some examples of single purchases that will instantly give you the maximum $20 cashback per category, when bought with the UOB EVOL Card:

- Online: A $250 digital lock bought at an online flash sale

- Contactless mobile: a $250 ergonomic office chair, bought in-store with the UOB EVOL Card via Apple Pay

- All other spends: $250 worth of groceries

However, if you find it way too easy to hit each categorical cap – well, perhaps you should also think about getting the UOB ONE Card to stack up on cashback (more on that next).

For those who want more cashback from day-to-day spending: UOB ONE Card

Image credit: ChannelNewsAsia (right)

To gain the most from everyday spend like groceries and cleaning supplies (as well as transport, beauty products, food deliveries…the list goes on), consider the UOB ONE Card.

If you’re new to UOB credit cards, you’ll enjoy up to 15% cashback from your daily commute via SimplyGo (bus/train rides), to your purchases at Shopee, Grab, or in any store under DFI Retail Group (e.g. Cold Storage, CS Fresh, Giant, Guardian and 7-Eleven, etc.)*.

*Valid until 31 December 2023.

Annually, all that cashback of up to 10% can add up to a whopping $2,000, or even higher should you get the new card during the promo period!

Here’s what you’re entitled to:

| Minimum spend of S$500/$1,000 per month | Minimum spend of S$2,000 per month | |

|---|---|---|

| Cashback on all retail spending | 3.33% (up to $50 or $100 respectively) | 3.33% (up to $200 cashback) |

| Additional cashback from selected partners (e.g. Shopee, Grab, Cold Storage, Giant, Guardian, etc.) | 5% | 6.67% |

| Additional cashback on Singapore Power utilities bill | 1% | 1% |

| Savings on fuel from Shell and SPC | Up to 22.66% | Up to 22.66% |

Between the UOB EVOL Card and UOB ONE Card, the latter has a higher cap on cashback based on tiered spending of S$500, S$1,000 and S$2,000. This makes it ideal for anyone who's just purchased a new house and is about to fork out on furniture and renovation.

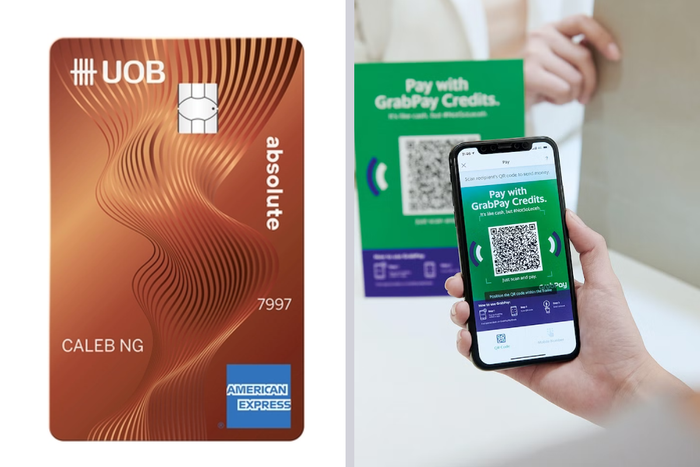

For those who prefer a fuss-free way to rack up benefits: UOB Absolute Card

On the other end of the spectrum, some of us don’t want the added stress of remembering which cards to use for different purposes, Or maybe you simply don’t have the time or energy to keep track of all your spending in different categories.

If so, the UOB Absolute Card is for you. Without a minimum spend, as well as you get to enjoy the 1.7% cashback with no cap, this credit card is the ultimate fuss-free way to earn as you spend – from groceries you purchase from your neighbourhood supermarket to a new kitchen appliance purchased online.

Unlike the UOB One Card, this cashback can be earned across all spends (i.e. you can earn cashback from both online and offline payments, as well as bill payments and insurance premiums). You won’t need to actively keep track of the spending done in each category to maximise your cashback.

Image credit: The Straits Times (right)

While the 1.7% cashback rate is lower than that of the UOB EVOL (8%) and the UOB One (up to 10%), what you have is the limitless cashback and absence of a minimum spend. After all, you know what they say: slow and steady wins the race!

And finally, the UOB Absolute Card is the only credit card in the market to award Grab mobile wallet top-up transactions. From this, you can earn 0.3% cashback, which you can then use to make payment at places that only accept PayNow or GrabPay, like your neighbourhood shop, or your favourite hawker centre stall.

Earn as you spend with UOB credit cards

The cost of living may be rising, but as we’ve explored, there are ways to make your dollar work for you. Find out how you can maximise your own cashback with UOB’s credit cards by clicking on the link below!

T&Cs apply for each of the aforementioned credit cards.

Get a budget estimate before meeting IDs

Get a budget estimate before meeting IDs