Short answer: It’ll make things easier for your finances. Long answer: Read on!

For most of us, buying a house in Singapore is probably going to be a huge financial commitment. With the price of a brand-new BTO flat being anywhere between $150K to $500K (depending on room size), you’ll most likely be tapping into a significant chunk of your savings to purchase your new home.

View this project by Dyel Design

Fortunately, if you’re a first-time homebuyer, there’s the Enhanced Housing Grant (EHG) that’ll help take a load (read: up to $80,000) off your shoulders. Here’s what you need to know about it:

First and foremost, what is the EHG?

View this project by Charlotte's Carpentry

The EHG is a government measure that was introduced in September 2019, and according to Minister Lawrence Wong, it’s meant to be “a major step forward in making HDB flats more affordable for all first-timers”.

But before we break it down in more detail, here are some key facts about the EHG that you’ll want to take note of:

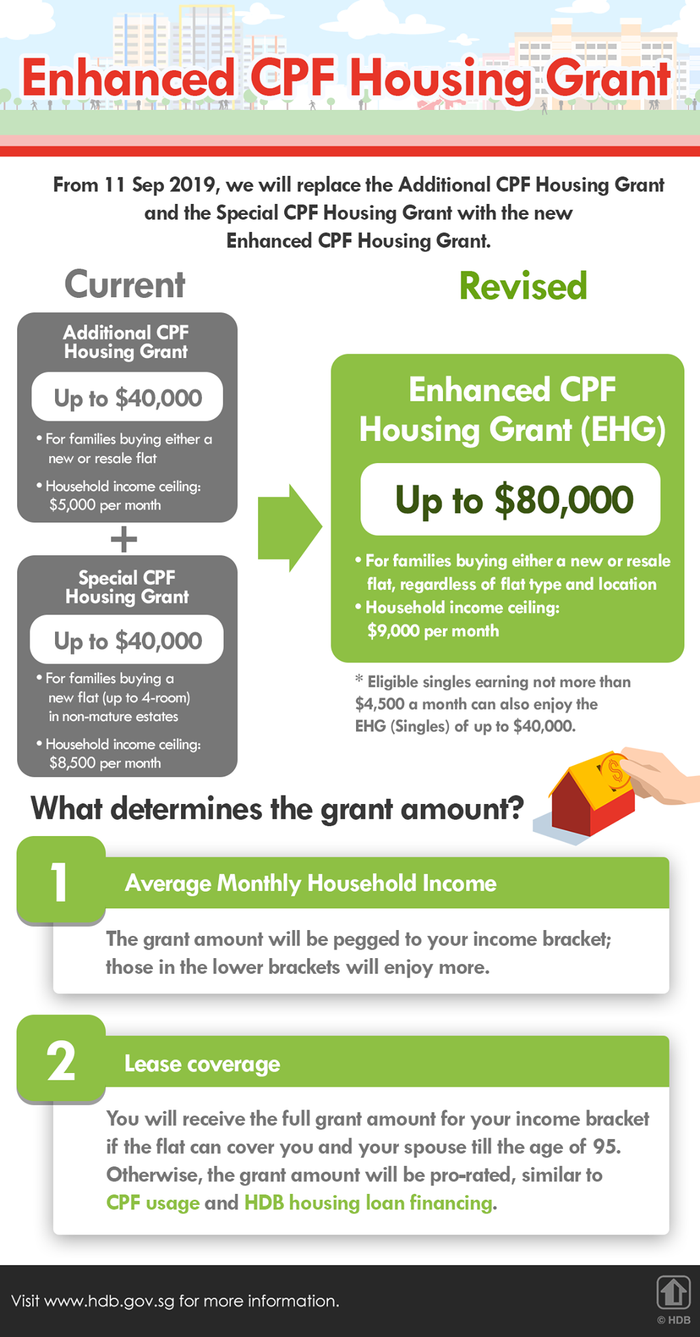

- The EHG is a replacement for the Additional CPF Housing Grant (AHG) and the Special CPF Housing Grant (SHG), which also served the same purpose of helping eligible first-time buyers purchase a flat.

- Unlike the SHG, the EHG is applicable for ALL flats, regardless of flat type (BTO or resale), size or location.

- It also has a higher income ceiling (combined monthly household income of up to $9,000) compared to that of the AHG’s (combined monthly household income of up to $5,000).

- The EHG is structured differently for singles and couples/families. For first-time singles who are 35 years old and above, the maximum eligible grant amount is $40,000, while it’s $80,000 for first-time couples/families.

- The EHG is only applicable for new flat applications from the September 2019 sales exercise and resale flat applications from 11th September 2019 onwards.

Will you be eligible for a larger grant amount with the EHG?

The answer is yes! But, that’s not the only benefit of the EHG as it’ll also give you more flexibility in buying a home in a desired location as compared to its SHG predecessor.

View this project by Inizio Atelier

Here’s a scenario to give you a better idea of how the EHG helps:

Imagine Couple A has an average monthly household income of $4,800 and they are thinking of buying a new 4-room BTO flat in Tampines, which is a mature estate.

| Before 11 September 2019 | From 11 September 2019 | |

|---|---|---|

| AHG | $5,000 | N/A |

| SHG | X | N/A |

| EHG | N/A | $45,000 |

| Grant amount awarded | $5,000 | $45,000 |

As seen in the table above, in the past (i.e. before 11th September 2019), they would have been eligible for the AHG with a $5,000 grant based on their average monthly household income and they would not have been eligible for the SHG due to their HDB home of choice being in a mature estate.

However, with the EHG, they would receive up to $45,000 based on their average monthly household income (see Table 2 below for exact grant figures for each income bracket) – that’s $40,000 more in grants!

What can the EHG be used for?

EHG grants can mainly be used for these two purposes:

- To offset the CPF portion of a flat’s purchase price.

- Reduce the mortgage loan on a flat purchase.

View this project by Urban Home Design 二本設計家

It cannot be used to:

- Pay for monthly mortgage instalments.

- Used for the minimum cash down payment of 5% for a bank housing loan.

How much will you receive from the EHG?

While the maximum grant amount under the EHG can go up to $80,000 for couples/families and $40,000 for singles, how much you’ll be receiving is determined by two factors:

- Your average monthly household income over the past 12 months; and also...

- The remaining lease on the HDB property you’ll be purchasing (this matters because if you’re buying a resale HDB flat the EHG amount granted will be pro-rated if the remaining lease doesn’t cover you and your spouse to the age of 95).

View this project by ChengYi Interior Design

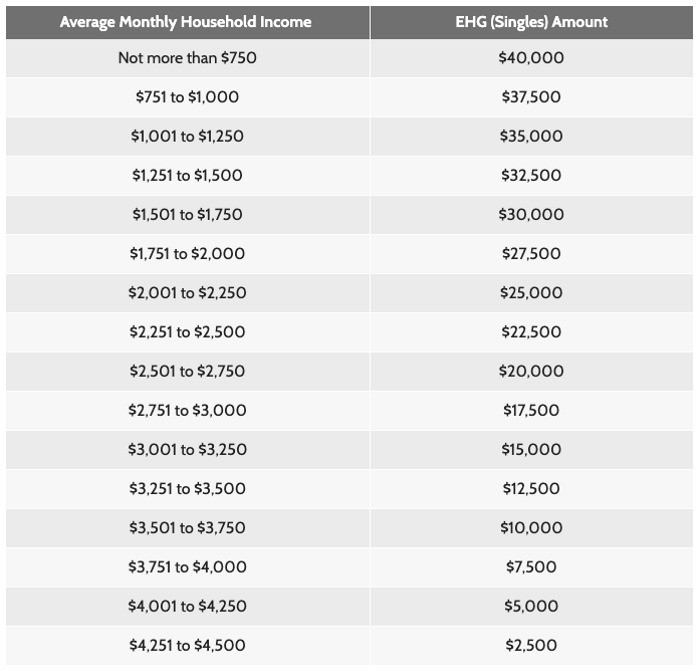

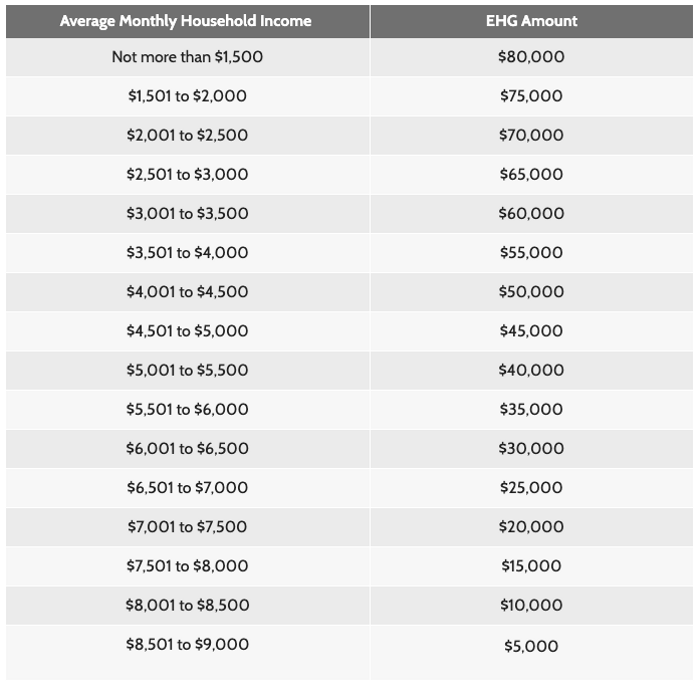

For easy reference, here are the EHG amounts that you’ll be eligible for! If you’re planning to apply as a single, refer to Table 1. If you’re applying as a couple/family, see Table 2.

Table 1 (EHG amount for singles):

Source: HDB

Table 2 (EHG amount for couples/families):

Source: HDB

Seeing as to how the remaining lease period on an HDB property has a role to play in determining how much you’ll be receiving from the EHG, here’s another scenario to help you understand how it changes things:

View this project by Luova Project Services

Imagine Couple C who are both 30 years old, have an average monthly household income of $4,800, and are deciding between Flat 1 (with a remaining lease of 65 years) and Flat 2 (with a remaining lease of 60 years).

| Flat 1 | Flat 2 | |

|---|---|---|

| Remaining lease on resale flat | 65 years | 60 years |

| Does the lease cover the owners till the age of 95? | Yes | No |

| EHG amount given | $45,000 (full amount for their income bracket) | $40,000 (prorated) |

Per the table above, the lease for Flat 1 covers them till the age of 95 and that gets them the fill EHG grant amount of $45,000 for their income bracket.

In comparison, the lease for Flat 2 only covers them till 90, and because of that they’ll only get a prorated EHG sum of $40,000.

Are you eligible for the EHG?

View this project by Great Oasis Interior Design

Last but not least, if you meet the following criteria, you’ll be eligible for the EHG:

a. Citizenship

If you’re married, at least one grant applicant has to be a Singapore citizen, i.e. a couple comprising of one Singaporean and a Permanent Resident can still qualify for the EHG.

b. Household income

To qualify for the minimum EHG grant amount, families should have an average monthly household income of less than or equal to $9,000, while for singles, it’s less than or equal $4,500.

c. Buyer status

Whether you’re purchasing a new BTO or a resale flat, you’ll need to be a first-time home buyer to be eligible.

d. Employment status

You and/or your spouse have to be employed at the time of flat application, and for a continuous 12 months period prior to that.

e. Property ownership

You must not have owned or sold a private/landed/overseas property within the last 30 months of making your EHG application.

Get to know HDB and your home better!

This article was adapted in collaboration with MyNiceHome, HDB’s official website for all things related to home buying and renovation in Singapore. Check out the original article here.

Need help renovating your home? Get interior designer recommendations here for free!

Get a budget estimate before meeting IDs

Get a budget estimate before meeting IDs