Start your journey to owning a resale HDB flat with this step-by-step guide with helpful links.

It goes without saying that the first step to achieving your dream HDB home is buying one, but if you aren’t planning purchasing a Built-to-Order (BTO) flat, your next option is to get one off the open market. But before you start, it’s best to know the important details and what you need to do for a successful purchase!

1. Check your eligibility

While it’s possible to start off by doing some research on the neighbourhoods that you’re most interested in, what you really need to find out is whether you’re eligible to purchase a resale flat. You will need to register for an HDB Flat Eligibility (HFE) letter, and connect with a financial institution to understand your housing loan options.

After you have submitted your HFE application, the HFE letter will tell you upfront about your eligibility.

View this project by U-Home Interior Design

For easy reference, here are some key eligibility conditions that apply to ALL resale flat purchases/schemes:

a. Income ceiling

Good news! If you’re buying a resale HDB flat, there’s no income ceiling restriction that you’ve to take note of. However, if you’re planning to apply for CPF Housing Grants and/or HDB Housing Loans, you’ll want to check if you meet their respective requirements.

b. Ownership/interest in HDB flats

If you or anyone else (e.g. family members) listed within your resale flat application is an owner of an HDB flat, he or she must sell it within six months of your new home’s purchase.

c. Ownership/interest in Singapore or overseas properties

Likewise, if you or another party in your resale flat application owns a private property (either local or overseas), he or she may dispose of it within the same six-month period.

2. Conduct research on flat prices

This step in the resale home buying process is probably as close as it gets to online shopping because it involves price-checking your desired flat(s) to get an idea of how much it should cost. You can do this by taking a look at the transacted prices of similar flats on HDB’s website; check back frequently because this database is updated daily based on registered resale flat sale applications!

View this project by erstudio

On a related note, you may wish to check out the Payment Plan Calculator, which will help you plan and prepare your finances by giving you estimated figures for important payment details – these include but aren’t limited to your HDB loans, monthly installments as well as fees required during resale appointments (e.g. cash payments, stamp fees, caveat fees, title search fees, etc.)

3. Register your purchase intent via HDB’s Flat Portal

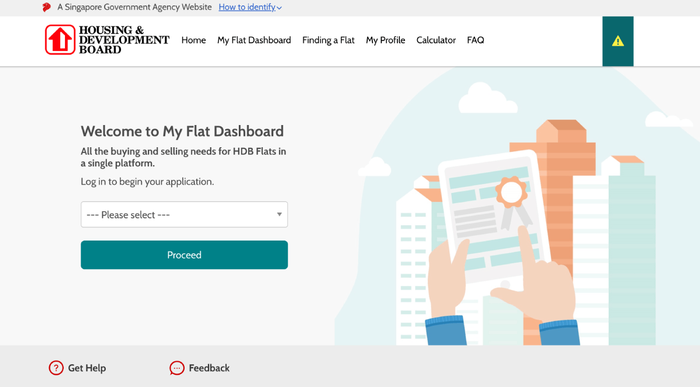

With both budgeting and eligibility out of the way, the next step in the process involves formalising your decision to purchase your new home, which brings us to HDB’s Flat Portal.

The My Flat Dashboard (aka the HDB Resale Portal) not only allows resale flat buyers to register their purchase intent but also integrates all related services/tasks – from handling personal particulars to keeping track of HDB housing loans – into a single online platform. So, be sure to keep it handy in your bookmarks!

4. Obtain the Option to Purchase and Request for Valuation

The Option to Purchase (OTP) is a legal contract between you and the flat’s seller and it’ll grant you the exclusive right to purchase a property that you’ve chosen. Upon receiving the OTP, you’ll need to submit a Request for Valuation, which determines the value of the flat, and in turn, your CPF usage and housing loan amounts from either HDB or a bank.

View this project by The Local INN.terior 新家室

Once again, both documents are obtainable through HDB’s Resale Portal. But do take note that in the case of the OTP, it’s only valid for 21 days during which you have to exercise it (read: purchase your chosen HDB resale flat).

Most resale flat owners will also start looking for an interior designer after acquiring the OTP, which leaves enough time for your designer to project an accurate cost/renovation period (especially in the case of older properties) and also for you to decide on a preferred look.

5. Submit the necessary paperwork and wait for your keys!

For the second-to-last step, both you and the flat seller are required to submit your respective portions of the resale application via the Resale Portal. After which, a sale completion appointment will be arranged to confirm the paperwork (e.g. Sales and Purchase agreement), and you can finally receive the keys to your new home!

The article was adapted from MyNiceHome, HDB’s official website for all things related to home buying and renovation in Singapore. The article was last updated in August 2023.

Get a budget estimate before meeting IDs

Get a budget estimate before meeting IDs